fulton county ga property tax sales

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. 48-5-311 e 3 B to review the appeal of.

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

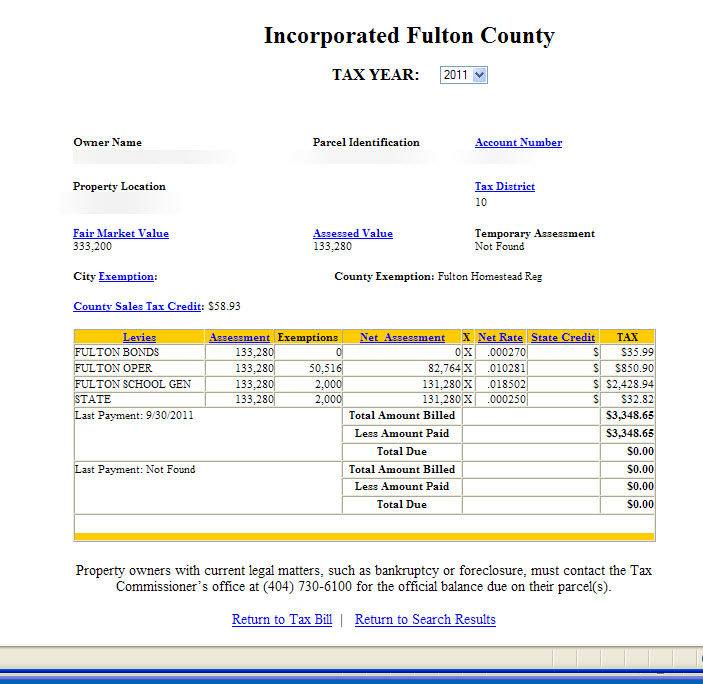

Fulton County collects the highest property tax in Georgia levying an average of 273300 108 of median home value yearly in property taxes while Warren County has the lowest property.

. For more information you maycontact the Tax Assessors Office at 404 612-6440 option 1. The current total local sales tax rate in Fulton County GA is 7750. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA.

Fulton County GA currently has 3434 tax liens available as of October 31. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia. Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes.

Tax Sales are held on the first Tuesday of each month between the hours of 10 am and 4 pm on the steps of the Fulton County Courthouse 136 Pryor Street SW except. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. The Fulton County sales tax rate is.

Due to renovations at the Fulton County Courthouse at 136 Pryor Street SW tax sales will be held on the steps of the Justice Center. Fultons rate inside Atlanta is 3. Has impacted many state nexus laws and sales tax collection.

SUT-2017-01 New Local Taxes 13182 KB. Present your photo ID when you arrive to. Click here to see the September 2022 Tax List.

Fulton County Board of Tax Assessors- City of Atlanta Solid Waste- Georgia Department of. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales. The December 2020 total local sales tax rate was also 7750.

TAX SALES BIDDER REGISTRATION. The 2018 United States Supreme Court decision in South Dakota v. Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone.

B O E Fulton County Superior Court Ga

Press Release Announcing A Proposed Property Tax Increase

Alpharetta Georgia Property Tax Calculator Millage Rate Homestead Exemptions

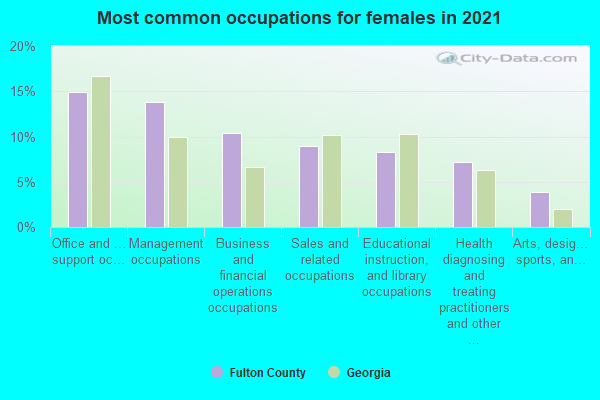

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ga News Fulton County Property Appeals Work Like This

Mayors Share Sales Tax Negotiations Status With North Fulton Residents Reporter Newspapers Atlanta Intown

Fulton County Ga Businesses For Sale Bizbuysell

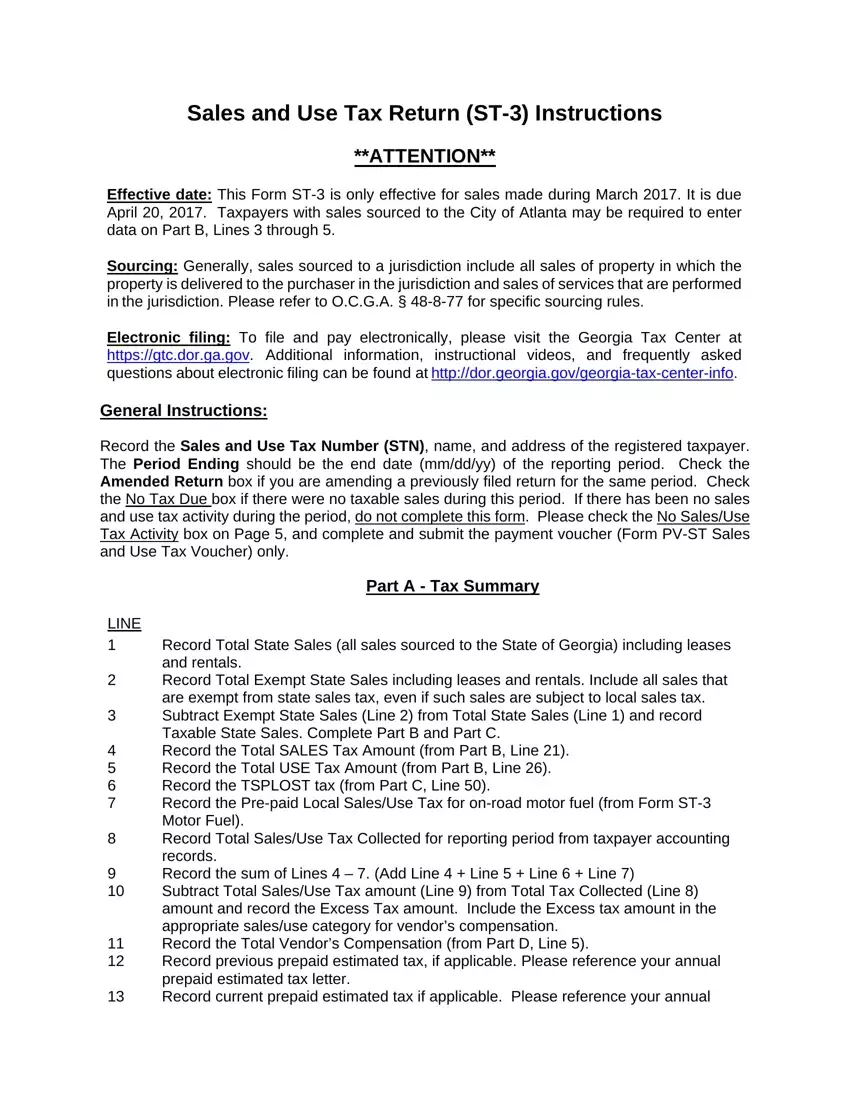

Ga St 3 Tax Fill Out Printable Pdf Forms Online

Atlanta News Fulton Co Accused Of Not Assessing Property Uniformly

A Look At North Fulton Ga Real Estate Resources And More North Fulton Georgia

Tax Deed Services For Owners Of Tax Deeds Gomez Golomb Llc

Johns Creek Local Option Sales Tax

City Of Roswell Property Taxes Roswell Ga

Meet Sheriff Labat Fulton County

Fulton County Property Tax Assessments Have Been Issued Here S What You Can Do Next 11alive Com

Opinion What To Know About Your Fulton County Tax Assessment Opinion Appenmedia Com